(The following post first appeared on Unionosity and is republished with permission.)

A group of 200 CEOs known as the Business Roundtable made some unsurprising recommendations for debt reduction [Wednesday], suggesting cutting entitlement programs and pushing the age of eligibility for Medicare and Social Security to 70. The recommendations, which the group plans to make to both Congress and the President, also resist any increased Social Security taxation on wealthy Americans.

[Reuters] reports:

The group would push the age at which full Social Security benefits are paid to 70 for those now aged 54 and under. Currently, the age for collecting full benefits depends on year of birth. Someone born between 1946 and 1953 can take full benefits at age 66. That will rise to age 67 for individuals born in 1960 or after.

The group is explicit in its goals to use the debt ceiling debate as an impetus to push radical policy initiatives.

What would it cost if the nation’s crumbling infrastructure of bridges, roads, rails, sewer systems, power grids, airports and more is allowed to deteriorate at its current pace? Some 3.5 million jobs and $3.1 trillion in lost economic output by 2020. What would it cost to avoid that? About $1.1 trillion in additional investment.

Sure sounds a like a great return on the investment and it is, according to a new report from the American Society of Civil Engineers (ASCE). The study, Failure to Act: The Impact of Infrastructure Investment on America’s Economic Growth, finds that:

Deteriorating infrastructure, long known to be a public safety issue, has a cascading impact on the nation’s economy, negatively affecting business productivity, gross domestic product, employment, personal income and international competitiveness.

ASCE finds that with an additional investment of $157 billion a year between now and 2020,

» Read more about: Our Crumbling Infrastructure: The Cost of Doing Nothing »

This week the Los Angeles Times reported that L.A. attracted a record number of tourists in 2012. More than 41.4 million out-of-town visitors came to our city for business, pleasure and everything in between – that’s about a million more visitors than in 2011. According to the Times piece, L.A.’s hotel occupancy rate in 2012 broke its pre-recession record, reaching 75.4 percent (the previous high was 75.1 percent in 2006).

Economic turnaround for tourism could be very good news for our city as a whole, because tourism is big business in Los Angeles – really big. Every year, tourism pumps more than $15 billion into our local economy. The tens of millions of business travelers, convention-goers and international and domestic visitors who come to Los Angeles make hospitality a primary economic engine for our city. It’s a simple formula: When visitors come to Los Angeles they spend their money in Los Angeles.

» Read more about: Will L.A.’s Tourism Boom Be a Bust for Workers & Economy? »

The headline to Daniel Borenstein’s recent Contra Costa Times column didn’t leave much to the imagination: “CalPERS planning to gut a key cost-control provision of new pension law.” Pairing CalPERS – the nation’s largest public employee retirement fund – with pension-reform sabotage promised red meat for conservatives who share the columnist’s disdain for unions. Borenstein didn’t let them down.

“By administrative fiat,” he wrote, “the California Public Employees’ Retirement System has undermined a key anti-spiking provision of the new state pension law that Gov. Jerry Brown signed last summer.” Not true, responded CalPERS, which claims Borenstein’s political biases led him to completely misrepresent its actions.

After sounding the alarm, Borenstein accused the government-run CalPERS of attempting to “fatten” pensions for new public employees while “eroding” the billions in tax dollar savings that the new law, crafted by Brown, was intended to create.

A few California local governments last week took a crucial step, almost unnoticed, to demand that banks pay back tens of millions of dollars which they allegedly conspired to take from the taxpayers. The City of Riverside, San Diego County, San Mateo County and five other government bodies sued almost two dozen multinational banks over the harm they allegedly caused taxpayers in the global “LIBOR” [London Interbank Offered Rate] scandal.

A few California local governments last week took a crucial step, almost unnoticed, to demand that banks pay back tens of millions of dollars which they allegedly conspired to take from the taxpayers. The City of Riverside, San Diego County, San Mateo County and five other government bodies sued almost two dozen multinational banks over the harm they allegedly caused taxpayers in the global “LIBOR” [London Interbank Offered Rate] scandal.

Notably absent from this initiative, however, are our California’s largest local governments: L.A. City and L.A. County. Equally notable is the failure of the news media, apart from specialized, business-oriented news services and blogs, to pay attention to what could be a major game changer in the 99%’s fight to make banks pay for crashing our economy.

Why should we care about something as obscure as the LIBOR financial index?

Because it set the interest rates for trillions of dollars in loans across all sectors of the global economy – ranging from your auto or home equity loan to multi-billion dollar government and corporate borrowings.

» Read more about: SoCal Governments Target Swap-Tainted Banks »

Readers of Monday’s New York Times may be forgiven for thinking an article by James Dao was about a new insult to America’s military veterans. After all, Dao reported that soon all vets separated from active duty within the past year, without dishonorable discharges, might be facing an even harsher existence than military life – as Walmart employees. Study after study has shown the retail behemoth to be a cutthroat employer of last resort, most of whose business innovations seem to involve new ways to save the corporation money by slashing employee hours and benefits.

Somehow, though, that didn’t figure much into the Times story. Instead, we read about a patriotic company with plans to hire 100,000 service men and women – essentially any American vet who needs a job. The recruitment begins Memorial Day, no less. According to the Times:

“Gary Profit,

» Read more about: Vets to Enter Walmart’s Supply Chain of Command »

Source: Warehouse Workers United

» Read more about: Walmart Cambodian Supplier Shuts Plant, Stiffs Workers »

TARP – the infamous Troubled Assets Relief Program that bailed out Wall Street in 2008 – is over. The Treasury Department announced it will be completing the sale of the remaining shares it owns of the banks and of General Motors.

TARP – the infamous Troubled Assets Relief Program that bailed out Wall Street in 2008 – is over. The Treasury Department announced it will be completing the sale of the remaining shares it owns of the banks and of General Motors.

But in reality it’s not over. The biggest Wall Street banks are now far bigger than they were four years ago when they were considered too big to fail. The five largest have almost 44 percent of all US bank deposits.

That’s up from 37 percent in 2007, just before the crash. A decade ago they had just 28 percent.

The biggest banks keep getting bigger because they can borrow more cheaply than smaller banks. That’s because investors believe the government will bail them out if they get into trouble, rather than force them into a form of bankruptcy (as the new Dodd-Frank law makes possible).

» Read more about: It’s Time to Roll Up the Welcome TARP for Big Banks »

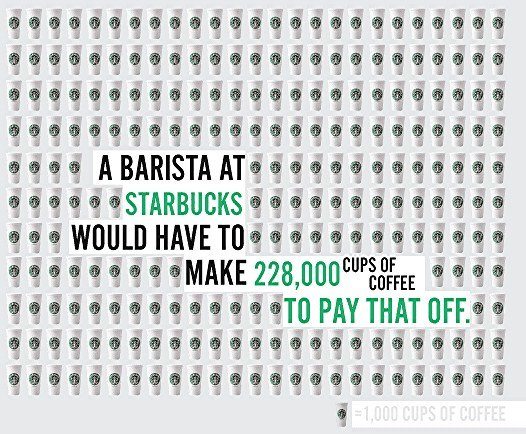

The following infographic first appeared with frugaldad.com‘s “College Isn’t Cheap” post and is republished with permission.