Co-published by Fast Company

California’s high rents are undermining tenants’ retirement prospects and the broader economy.

A landmark, IRA-type retirement savings program created for millions of Californians, came under threat last week when House Republicans passed a joint resolution aimed at blocking states from setting up such payroll savings plans.

As next week’s June 15 budget deadline looms, legislative leaders hammering out differences between the Assembly and Senate versions of this year’s $171 billion budget for the fiscal year that begins July 1 will also be deciding the fate of retirement security for future University of California workers.

Consuelo Mendez was 23 when she arrived in the United States 45 years ago, looking for work. In Ventura County she found it, harvesting strawberries, tomatoes, cabbage, parsley and spinach.

As soon as Anastasia Flores’ children were old enough, she brought them with her to work in the fields. “Ever since 1994 I’ve always worked by myself, until my children could also work,” she recalls.

Sue Poucher, 64, is a Navy veteran from Michigan who joined the paid workforce at age 18, and left it in April 2014, due to a lack of job openings in her field, retail sales. She was one of 200 people who attended a daylong conference in Sacramento Oct. 15. The gathering, called “Tomorrow’s California: New Visions for Retirement Security,” focused on the release of a new report on aging, economics, public resources and policy solutions.

“I get Cal-Fresh, live in U.S. Housing and Urban Development subsidized senior housing and rely solely on my $943 monthly Social Security check,” Poucher told Capital & Main at the conference. “When food prices go up, what are you supposed to do, not eat?”

Nearly two-thirds of California’s private-sector workers lack employer-sponsored retirement plans.

The Sacramento resident has no savings to fall back on,

» Read more about: Conference Sees Hard Road for Retiring Californians »

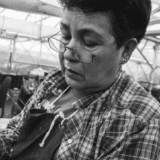

California’s senior population is expected to increase by 64 percent in the next two decades, and most will be financially unprepared for retirement. This is according to a report from researchers at the University of British Columbia and the University of California, Berkeley. Their study, Aging California’s Retirement Crisis: State and Local Indicators, was commissioned by California Retirement Security for All and projects population expansions among seniors to be felt most in the Los Angeles and Central Valley regions, with economically vulnerable Latinos, African-Americans, women and renters accounting for an increasing share.

“Our study clearly shows a mounting retirement crisis in California, and with the threat of poverty in the senior years falling hardest on people of color, workers in low-wage jobs, women, and immigrants,” said the report’s editor, Dr. Nari Rhee of the Retirement Security Program at U.C. Berkeley.

The report was introduced today at a Sacramento conference called “Build Tomorrow’s California: New Visions for Retirement Security,” attended by community advocates,

» Read more about: Uncertain Times Ahead for California's Aging »

When Democratic former San Jose mayor Chuck Reed and Republican ex-San Diego councilmember Carl DeMaio finally unveiled the language for a promised attempt at getting a statewide public pension cutting measure to 2016 voters, the expectation was that Reed II would be a reined-in and more realistically-framed version of Reed I – last year’s failed attempt at undermining the public pension system.

That try for the 2014 ballot was aborted after Attorney General Kamala Harris slapped it with a candid, albeit politically untenable summary that frankly described the proposed constitutional amendment as targeting longstanding legal rights—rights that protect the pensions and retirement health care of the 1.64 million Californians enrolled in the state’s public pension systems.

But even veterans of the state’s public-sector retirement wars were unprepared for the sheer scale of what awaited them this time around.

» Read more about: Measure of Deception: CA Initiative Would Gut Retirement Benefits for Millions »

Thousands of aging and disabled Californians, along with their home care providers, have been on edge to see if a seven percent cut in home care services will be restored in the state budget, as Jim Crogan details for Capital & Main. But this year’s tug-of-war at the margins of the state budget is just a foreshadowing of serious struggles to come over the next 15 years as a tidal wave of new seniors changes the face of our state.

The number of Californians over 65 will nearly double by 2030.

Despite California’s falling birth rates, the state’s population has grown faster and stayed younger than the country on average, thanks to immigration. But the outsized numbers of baby boomers has begun to outweigh those moving in, and it will leave us with a much older population.

Maria Bustillos and Elizabeth Fladung share their views about a trip to Palm Springs, land of mountains, casinos and trailer parks.

This podcast is an encore posting from our State of Inequality series.[divider]Maria Bustillos is a journalist and critic living in Los Angeles.

Elizabeth Fladung is a Brooklyn-based, CalArts-trained photojournalist. Her work has appeared in The Nation, La Repubblica, The Fader and Wax Poetics Magazine.

[SlideDeck2 id=44608]

Trailers! Casinos! Sunsets! Photographer Elizabeth Fladung captures a metaphorical Palm Springs.

This slideshow is an encore posting from our State of Inequality series.[divider]

Elizabeth Fladung is a Brooklyn-based, CalArts-trained photojournalist. Her work has appeared in The Nation, La Repubblica, The Fader and Wax Poetics Magazine.

Four years ago I retired from active ministry in the United Methodist Church. My wife Susan and I now live a comfortable, middle-class life based upon the three pillars of retirement. We both receive Social Security. We get a monthly check from my pension plan. We hold some savings. But that’s not true for most Americans.

Yes, retiring workers can look forward to Social Security if they have paid into it. But that automatically excludes some. Government employees, for example, get pensions, but not Social Security. Undocumented workers may have the Social Security tax deducted from their paychecks, but the funds likely go to an account that does not bear their names – therefore, they will not get those payroll taxes returned to them when they age into eligibility.

Besides, Social Security was from the beginning expected to provide supplemental income only, not the sole basis for a livelihood.

It’s official: America has entered a retirement crisis. Or, as Forbes understatedly put it, “the greatest retirement crisis in the history of the world.”

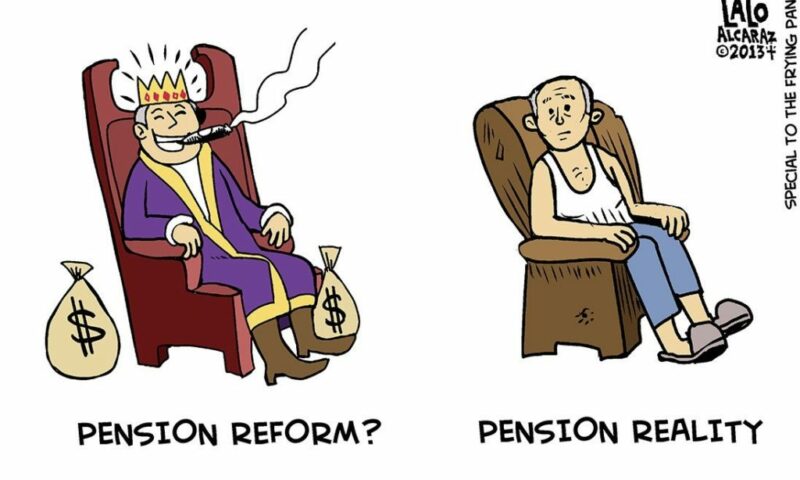

Frying Pan News recently spoke with some former state, county and municipal workers for a picture of how their retirements have been living up to their expectations.

Norma Anders, Long Beach

Retired career librarian Norma Anders’ eyes light up when she speaks of her 30 years in the City of Los Angeles’ public library system. “We make a big difference,” she declares proudly. “We’re one of the forces that’s giving our country an educated workforce, an informed citizenry. [It’s how] we’re going to be able to keep our [nation] growing and growing.”

Anders is having her morning tea in the well-manicured front yard of the modest clapboard house she shares with her retired husband, David, and her son Lee, who has moved back home while he finishes an accounting degree at Long Beach State.

» Read more about: Pension Shock: Interviews With Three Retired Public Employees »

It’s official: America has entered a retirement crisis. Or, as Forbes understatedly put it, “the greatest retirement crisis in the history of the world.”

Frying Pan News recently spoke with some former state, county and municipal workers for a picture of how their retirements have been living up to their expectations.

Norma Anders, Long Beach

Retired career librarian Norma Anders’ eyes light up when she speaks of her 30 years in the City of Los Angeles’ public library system. “We make a big difference,” she declares proudly. “We’re one of the forces that’s giving our country an educated workforce, an informed citizenry. [It’s how] we’re going to be able to keep our [nation] growing and growing.”

Anders is having her morning tea in the well-manicured front yard of the modest clapboard house she shares with her retired husband, David, and her son Lee, who has moved back home while he finishes an accounting degree at Long Beach State.

» Read more about: Not So Golden Years in the Golden State »

To the let’s-cut-entitlements crowd, what’s wrong with America is that seniors are living too high off the hog. With the cost of medical care still rising (though not as fast as it used to), the government is shelling out many more dollars per geezer (DPG) than it is per youngster (DPY). The solution, we’re told, is to bring down DPG so we can boost DPY.

We do indeed need to boost DPY. And we need to rein in medical costs by shifting away from the fee-for-service model of billing and paying. But as for changing the way we calculate cost-of-living adjustments for seniors to keep us from overpaying them — an idea beloved of Bowles, Simpson, Republicans and, apparently, the White House — this may not be such a hot idea, for one simple reason: An increasing number of seniors can’t afford to retire.

Nearly one in five Americans age 65 and over — 18.5 percent — were working in 2012,

“Is there an age limit on those energy efficiency jobs you were talking about, sir?” asked an elderly woman with a heavy, Eastern European-sounding accent.

Assuming that she was inquiring for her grandchild, I told her that those interested in signing up for IBEW Local 18’s Utility Pre-Craft Trainee position must be at least 18 years old, have a valid California driver’s license and be proficient in math and English.

Just as I was about to continue with my tutorial about the academic and physical fitness requirements, the woman interrupted me with another question.

“Do you have any jobs that I can do?”

The wrinkled skin on her face, thin grey hair and her membership in the senior center I was speaking at suggested that she was at least in her mid-sixties. However, I would not be surprised if she was solidly in her seventies.

In 2005, Hewlett-Packard paid Carly Fiorina $40-million if she promised not to come to work anymore. The absurd payoff followed the company’s stock plunge during Fiorina’s six-year tenure as CEO. That $40-million could have gone to staff, shareholders or new hires.

Since then, most Americans — for whom the phrase “retirement package” is a cruel joke — have watched their net worth collapse while CEO payouts have reached heights far beyond the reach of mortal men.

A study released earlier this year by GMI, a corporate-governance rating and research firm, found that the golden parachutes of just 21 CEOs collectively add up to nearly $4 billion. (That’s Carly’s massive kiss-off multiplied by 100.) You don’t want to know how rich every one of these guys — yes, they are all guys — was to begin with.

Former Penn State football coach Joe Paterno died in January after being fired for helping to cover up the systematic sexual abuse of kids under his watch.

Social Security, Medicare and Medicaid are under attack by Republican lawmakers. Whether it is the Romney/Ryan budget that would end Medicare as we know it or proposals to privatize and cut Social Security, members of the Alliance for Retired Americans are pushing back and mobilizing with new “Let’s Not Be the Last Generation to Retire” campaign.

During the next few weeks to coincide with Medicare’s and Medicaid’s 47th anniversary July 30 and Social Security’s 77th on Aug. 14, Alliance members will sponsor educational briefings at senior centers and organize protests outside offices of lawmakers who have voted against the needs of local retirees. Says Alliance President Barbara Easterling:

Our goal is to educate seniors on the issues and on where elected officials and candidates stand. We need to clear up all the misinformation that is being spread by the big business groups and the right-wing commentators on TV.

» Read more about: Let’s Not Be the Last Generation to Retire »