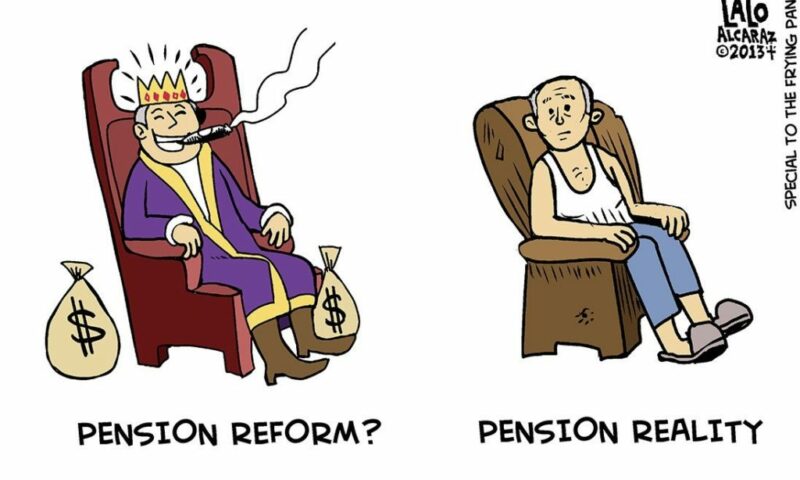

Call it the tale of two pension crises. In June, the Los Angeles Times’ business pages looked at the looming retirement savings disaster caused by the nearly 40-year transition from employer-sponsored defined-benefit pensions to individual 401(k) plans — a sea change in retirement insecurity, it noted, that “has been a failure for all but the wealthiest Americans.”

On Tuesday, California Attorney General Kamala Harris will release the official title and summary that will appear on the 2016 ballot for former San Jose mayor Chuck Reed’s latest statewide public-sector pension cutting initiative.

That language will finally end speculation on how far Harris will go in describing the sweeping scope of the proposed constitutional amendment. Legal analysts have charged that it contains a hidden trigger aimed at not just slashing pension benefits but annihilating 60 years of state pension law along with the vast retirement systems that together guarantee the retirement promises made to California’s public employees.

Initial clues as to what might appear on the 2016 ballot emerged last week as the first formal responses by state officials to the proposed measure began to trickle in.

The stakes for all Californians in the so-called “Voter Empowerment Act of 2016” couldn’t be higher.

For Reed and his supporters,

» Read more about: Countdown to Disaster: Grim Official Estimates on 2016 Pension Cutting Measure »

When Democratic former San Jose mayor Chuck Reed and Republican ex-San Diego councilmember Carl DeMaio finally unveiled the language for a promised attempt at getting a statewide public pension cutting measure to 2016 voters, the expectation was that Reed II would be a reined-in and more realistically-framed version of Reed I – last year’s failed attempt at undermining the public pension system.

That try for the 2014 ballot was aborted after Attorney General Kamala Harris slapped it with a candid, albeit politically untenable summary that frankly described the proposed constitutional amendment as targeting longstanding legal rights—rights that protect the pensions and retirement health care of the 1.64 million Californians enrolled in the state’s public pension systems.

But even veterans of the state’s public-sector retirement wars were unprepared for the sheer scale of what awaited them this time around.

» Read more about: Measure of Deception: CA Initiative Would Gut Retirement Benefits for Millions »

Capital & Main recently looked at a spate of negative headlines about public pension funds, spurred by data that State Controller John Chiang released on his new public data site at ByTheNumbers.sco.ca.gov.

Chiang has served as Controller since 2006, acting as California’s Chief Fiscal Officer. He was recently elected as State Treasurer and will switch to that office next year. In both roles, Chiang sits on the Boards of Administration for the two largest public employee funds, California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS).

Capital & Main followed up with the Controller to ask about the state of pension systems in California and how those systems should be looking to the future.

[divider]

The data you posted on your By the Numbers site led to many existing critics of pension saying “See?

» Read more about: Controller John Chiang on the Future of California’s Public Pensions »

Four years ago I retired from active ministry in the United Methodist Church. My wife Susan and I now live a comfortable, middle-class life based upon the three pillars of retirement. We both receive Social Security. We get a monthly check from my pension plan. We hold some savings. But that’s not true for most Americans.

Yes, retiring workers can look forward to Social Security if they have paid into it. But that automatically excludes some. Government employees, for example, get pensions, but not Social Security. Undocumented workers may have the Social Security tax deducted from their paychecks, but the funds likely go to an account that does not bear their names – therefore, they will not get those payroll taxes returned to them when they age into eligibility.

Besides, Social Security was from the beginning expected to provide supplemental income only, not the sole basis for a livelihood.

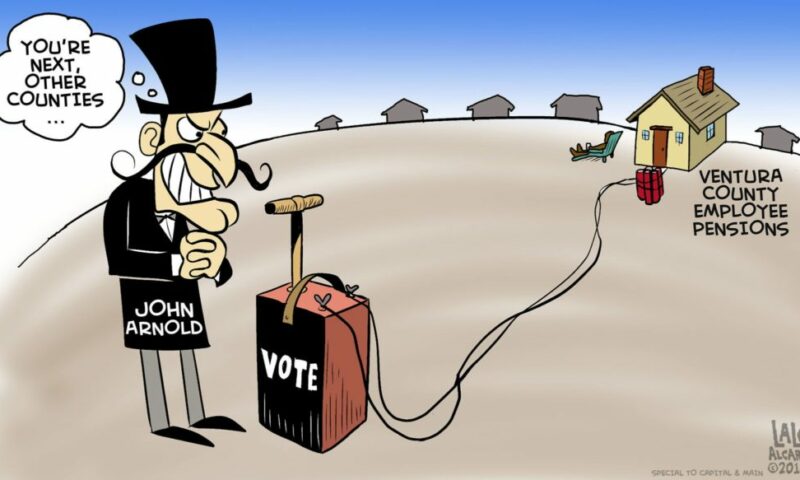

A Ventura County judge Monday issued a setback to anti-pension zealots who have been working to roll back public employee benefits. The judge’s tentative ruling found fundamental flaws in a ballot measure to cut county employee pensions and concluded that putting it before voters would amount to nothing more than a waste of public tax dollars – a rebuke that must smart among groups who identify themselves as taxpayer advocates.

One of their central tactics has been to stir up resentment among the public, most of whom have seen their own benefits shrivel up over the years, then place measures on the ballot to slash public employee pensions. As Capital & Main’s Gary Cohn reported, anti-tax activists saw this particular Ventura measure as a template for what would be a wave of pension rollback measures.

“I guarantee you that when this passes, in 2016 every ’37 Act county will have this on their ballot,” Ventura County Supervisor Peter Foy said at the time.

» Read more about: Illegal Ballot Measure a Setback for Anti-Pension Activists »

Jon Coupal is nothing if not blunt when he describes one motive behind a Ventura County ballot measure that would replace the “defined benefit” pensions currently enjoyed by county employees and replace them with 401(k)-type plans for all future hires.

“This is meant to be a template for other counties,” Coupal tells Capital & Main. By that, the Howard Jarvis Taxpayers Association’s president means the measure’s conservative and libertarian backers see the “Sustainable Retirement System Initiative” as the newest and most promising weapon in their assault on California’s public employee retirement plans. Having failed to place similar measures on state ballots in 2012 and 2014, a coalition of wealthy individuals, anti-tax activists and government privatizers has seized on an aspect of California law that allows 20 counties to fashion their own public employee retirement policies apart from the CalPERS system that administers such policies for nearly all of the state’s remaining 38 counties.

» Read more about: Domino Effect: Pension Cutters Gamble on a California Ballot Measure »

Last week’s announcements about 2013 earnings by California’s largest public pension funds suggest the agencies may be making significant progress in shaking off the lingering after-effects of the 2008 stock market crash.

The California Public Employees’ Retirement System (CalPERS) said it rode a 25 percent run-up in stock prices to post a 16.2 percent gain for its 2013 portfolio — its best showing in a decade. For its part, the California State Teachers’ Retirement System (CalSTRS) reported an impressive 19.1 percent return on its 2013 investments, led by a 28 percent return on its stock holdings.

The announcements undoubtedly came as welcome news to the roughly 1.6 million California government workers and 860,000 public school teachers represented by the systems. Ever since the 2008 global financial meltdown, their pensions have been in the crosshairs of fiscal conservatives and anti-public pension activists who wish to see the employees’

Late Monday afternoon California Attorney General Kamala Harris released the state’s official title and summary for the ballot initiative promoted by San Jose Mayor Chuck Reed and others to reduce the retirement benefits of state and municipal workers. Harris’ wording had been anxiously awaited by Reed and his colleagues. In 2012 a different group of pension-cutters abandoned their measure, according to the Sacramento Bee, after they tested Harris’ summary and found it would make their measure radioactive at the polls.

Reed had called his proposal the Pension Reform Act of 2014 and, no doubt, had his fingers crossed that it would appear that way on a future ballot. If so, he was in for a disappointment, as the attorney general rebranded the measure as the less lyrical Public Employees Pension and Retiree Healthcare Benefits Initiative Constitutional Amendment. To the pension-cutters’ further chagrin, Harris’ description placed teachers,

» Read more about: Can Chuck Reed’s Pension-Cutting Campaign Get Off the Ground? »

It’s official: America has entered a retirement crisis. Or, as Forbes understatedly put it, “the greatest retirement crisis in the history of the world.”

Frying Pan News recently spoke with some former state, county and municipal workers for a picture of how their retirements have been living up to their expectations.

Norma Anders, Long Beach

Retired career librarian Norma Anders’ eyes light up when she speaks of her 30 years in the City of Los Angeles’ public library system. “We make a big difference,” she declares proudly. “We’re one of the forces that’s giving our country an educated workforce, an informed citizenry. [It’s how] we’re going to be able to keep our [nation] growing and growing.”

Anders is having her morning tea in the well-manicured front yard of the modest clapboard house she shares with her retired husband, David, and her son Lee, who has moved back home while he finishes an accounting degree at Long Beach State.

» Read more about: Pension Shock: Interviews With Three Retired Public Employees »

It’s official: America has entered a retirement crisis. Or, as Forbes understatedly put it, “the greatest retirement crisis in the history of the world.”

Frying Pan News recently spoke with some former state, county and municipal workers for a picture of how their retirements have been living up to their expectations.

Norma Anders, Long Beach

Retired career librarian Norma Anders’ eyes light up when she speaks of her 30 years in the City of Los Angeles’ public library system. “We make a big difference,” she declares proudly. “We’re one of the forces that’s giving our country an educated workforce, an informed citizenry. [It’s how] we’re going to be able to keep our [nation] growing and growing.”

Anders is having her morning tea in the well-manicured front yard of the modest clapboard house she shares with her retired husband, David, and her son Lee, who has moved back home while he finishes an accounting degree at Long Beach State.

» Read more about: Not So Golden Years in the Golden State »

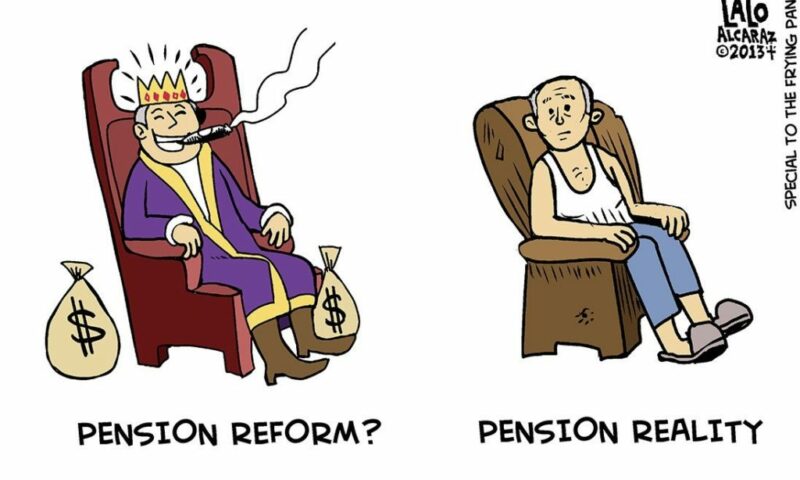

As Gary Cohn and Bill Raden point out in a recent Frying Pan News piece, it’s become the pastime of conservatives to skew debates over public employee pensions by singling out the comparatively high retirement benefits of “top-tier city and county executives,” while ignoring the typical pensions earned by the vast majority of government workers. This ploy is also used, naturally, in propaganda decrying the salaries of public sector employees while they are still actively working for states and cities.

The Center for Media and Democracy’s new project, Outsourcing America Exposed, has discovered that there is, in fact, a breed of “government worker” whose members receive sky-high, taxpayer-funded salaries. They are not teachers or librarians, however, but “CEOs whose corporations make billions by taking control of public services.”

Says CMD executive director Lisa Graves: “Taxpayers are being duped by corporate CEOs and Wall Street banks that are siphoning money out of our communities for huge salaries and bonus packages.”

Graves is referring to the gold-plated trough known as privatization,

» Read more about: How Public Taxes Became a CEO’s Personal Income »

It’s official: America has entered a retirement crisis. Or, as Forbes understatedly put it, “the greatest retirement crisis in the history of the world.”

And, while the causes are manifold — the demographic bulge of baby boomers leaving the fulltime workforce; greater worker longevity; the disastrous, 30-year shift from traditional defined benefit pensions to costly 401(k)-style plans — most experts agree that the national retirement implosion has gone critical, with an estimated 75 percent of Americans who are nearing retirement age having less than $27,000 in their retirement accounts.

Even John C. Bogle, the founder of the $2 trillion mutual fund and 401(k) behemoth Vanguard Group, recently admitted that the system of retirement plans that rely on 401(k)s is broken.

“[401(k)s were] designed as a thrift plan, and it doesn’t work as a retirement plan,” Bogle declared.

So it is with some irony that a Texas hedge fund billionaire/former Enron trader and a politically ambitious Northern California mayor have teamed up to cripple one of the few parts of the retirement story that still works — California’s public-sector pension system.

» Read more about: My Body Isn’t 40 Anymore: Three Faces of Retirement »

The headline to Daniel Borenstein’s recent Contra Costa Times column didn’t leave much to the imagination: “CalPERS planning to gut a key cost-control provision of new pension law.” Pairing CalPERS – the nation’s largest public employee retirement fund – with pension-reform sabotage promised red meat for conservatives who share the columnist’s disdain for unions. Borenstein didn’t let them down.

“By administrative fiat,” he wrote, “the California Public Employees’ Retirement System has undermined a key anti-spiking provision of the new state pension law that Gov. Jerry Brown signed last summer.” Not true, responded CalPERS, which claims Borenstein’s political biases led him to completely misrepresent its actions.

After sounding the alarm, Borenstein accused the government-run CalPERS of attempting to “fatten” pensions for new public employees while “eroding” the billions in tax dollar savings that the new law, crafted by Brown, was intended to create.

In 2005, Hewlett-Packard paid Carly Fiorina $40-million if she promised not to come to work anymore. The absurd payoff followed the company’s stock plunge during Fiorina’s six-year tenure as CEO. That $40-million could have gone to staff, shareholders or new hires.

Since then, most Americans — for whom the phrase “retirement package” is a cruel joke — have watched their net worth collapse while CEO payouts have reached heights far beyond the reach of mortal men.

A study released earlier this year by GMI, a corporate-governance rating and research firm, found that the golden parachutes of just 21 CEOs collectively add up to nearly $4 billion. (That’s Carly’s massive kiss-off multiplied by 100.) You don’t want to know how rich every one of these guys — yes, they are all guys — was to begin with.

Former Penn State football coach Joe Paterno died in January after being fired for helping to cover up the systematic sexual abuse of kids under his watch.

Social Security, Medicare and Medicaid are under attack by Republican lawmakers. Whether it is the Romney/Ryan budget that would end Medicare as we know it or proposals to privatize and cut Social Security, members of the Alliance for Retired Americans are pushing back and mobilizing with new “Let’s Not Be the Last Generation to Retire” campaign.

During the next few weeks to coincide with Medicare’s and Medicaid’s 47th anniversary July 30 and Social Security’s 77th on Aug. 14, Alliance members will sponsor educational briefings at senior centers and organize protests outside offices of lawmakers who have voted against the needs of local retirees. Says Alliance President Barbara Easterling:

Our goal is to educate seniors on the issues and on where elected officials and candidates stand. We need to clear up all the misinformation that is being spread by the big business groups and the right-wing commentators on TV.

» Read more about: Let’s Not Be the Last Generation to Retire »