Capital & Main recently looked at a spate of negative headlines about public pension funds, spurred by data that State Controller John Chiang released on his new public data site at ByTheNumbers.sco.ca.gov.

Chiang has served as Controller since 2006, acting as California’s Chief Fiscal Officer. He was recently elected as State Treasurer and will switch to that office next year. In both roles, Chiang sits on the Boards of Administration for the two largest public employee funds, California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS).

Capital & Main followed up with the Controller to ask about the state of pension systems in California and how those systems should be looking to the future.

[divider]

The data you posted on your By the Numbers site led to many existing critics of pension saying “See?

» Read more about: Controller John Chiang on the Future of California’s Public Pensions »

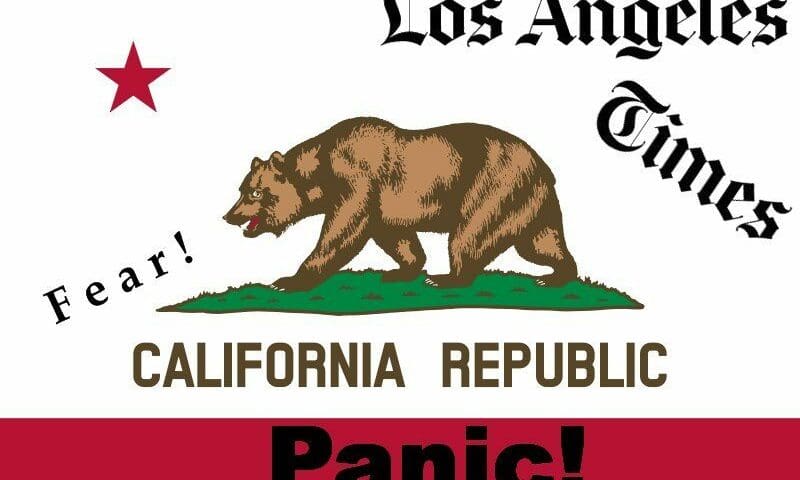

“California pension funds are running dry,” warned a recent Los Angeles Times headline.

“The unfunded liability— that’s the difference between promised benefits and projected funds to fulfill those obligations — grew from about $6.3 billion in 2003 to a little more than $198 billion in 2013,” Santa Rosa’s Press Democrat chimed in, helpfully doing the math to point out that’s a 30-fold increase in 11 years.

“The system, in short, is completely, utterly broken,” concluded the Orange County Register.

Despite nothing significant changing in the retirement plans themselves, public employee pensions are back in the news, and apparently panic is in the air.

Why? In late October State Controller John Chiang posted data on 130 state and local pension funds as part of his new By the Numbers website.

» Read more about: California Pensions: Encouraging News v. Scary Headlines »