(The following post first appeared on Unionosity and is republished with permission.)

A group of 200 CEOs known as the Business Roundtable made some unsurprising recommendations for debt reduction [Wednesday], suggesting cutting entitlement programs and pushing the age of eligibility for Medicare and Social Security to 70. The recommendations, which the group plans to make to both Congress and the President, also resist any increased Social Security taxation on wealthy Americans.

[Reuters] reports:

The group would push the age at which full Social Security benefits are paid to 70 for those now aged 54 and under. Currently, the age for collecting full benefits depends on year of birth. Someone born between 1946 and 1953 can take full benefits at age 66. That will rise to age 67 for individuals born in 1960 or after.

The group is explicit in its goals to use the debt ceiling debate as an impetus to push radical policy initiatives.

What would it cost if the nation’s crumbling infrastructure of bridges, roads, rails, sewer systems, power grids, airports and more is allowed to deteriorate at its current pace? Some 3.5 million jobs and $3.1 trillion in lost economic output by 2020. What would it cost to avoid that? About $1.1 trillion in additional investment.

Sure sounds a like a great return on the investment and it is, according to a new report from the American Society of Civil Engineers (ASCE). The study, Failure to Act: The Impact of Infrastructure Investment on America’s Economic Growth, finds that:

Deteriorating infrastructure, long known to be a public safety issue, has a cascading impact on the nation’s economy, negatively affecting business productivity, gross domestic product, employment, personal income and international competitiveness.

ASCE finds that with an additional investment of $157 billion a year between now and 2020,

» Read more about: Our Crumbling Infrastructure: The Cost of Doing Nothing »

This week the Los Angeles Times reported that L.A. attracted a record number of tourists in 2012. More than 41.4 million out-of-town visitors came to our city for business, pleasure and everything in between – that’s about a million more visitors than in 2011. According to the Times piece, L.A.’s hotel occupancy rate in 2012 broke its pre-recession record, reaching 75.4 percent (the previous high was 75.1 percent in 2006).

Economic turnaround for tourism could be very good news for our city as a whole, because tourism is big business in Los Angeles – really big. Every year, tourism pumps more than $15 billion into our local economy. The tens of millions of business travelers, convention-goers and international and domestic visitors who come to Los Angeles make hospitality a primary economic engine for our city. It’s a simple formula: When visitors come to Los Angeles they spend their money in Los Angeles.

» Read more about: Will L.A.’s Tourism Boom Be a Bust for Workers & Economy? »

The headline to Daniel Borenstein’s recent Contra Costa Times column didn’t leave much to the imagination: “CalPERS planning to gut a key cost-control provision of new pension law.” Pairing CalPERS – the nation’s largest public employee retirement fund – with pension-reform sabotage promised red meat for conservatives who share the columnist’s disdain for unions. Borenstein didn’t let them down.

“By administrative fiat,” he wrote, “the California Public Employees’ Retirement System has undermined a key anti-spiking provision of the new state pension law that Gov. Jerry Brown signed last summer.” Not true, responded CalPERS, which claims Borenstein’s political biases led him to completely misrepresent its actions.

After sounding the alarm, Borenstein accused the government-run CalPERS of attempting to “fatten” pensions for new public employees while “eroding” the billions in tax dollar savings that the new law, crafted by Brown, was intended to create.

A few California local governments last week took a crucial step, almost unnoticed, to demand that banks pay back tens of millions of dollars which they allegedly conspired to take from the taxpayers. The City of Riverside, San Diego County, San Mateo County and five other government bodies sued almost two dozen multinational banks over the harm they allegedly caused taxpayers in the global “LIBOR” [London Interbank Offered Rate] scandal.

A few California local governments last week took a crucial step, almost unnoticed, to demand that banks pay back tens of millions of dollars which they allegedly conspired to take from the taxpayers. The City of Riverside, San Diego County, San Mateo County and five other government bodies sued almost two dozen multinational banks over the harm they allegedly caused taxpayers in the global “LIBOR” [London Interbank Offered Rate] scandal.

Notably absent from this initiative, however, are our California’s largest local governments: L.A. City and L.A. County. Equally notable is the failure of the news media, apart from specialized, business-oriented news services and blogs, to pay attention to what could be a major game changer in the 99%’s fight to make banks pay for crashing our economy.

Why should we care about something as obscure as the LIBOR financial index?

Because it set the interest rates for trillions of dollars in loans across all sectors of the global economy – ranging from your auto or home equity loan to multi-billion dollar government and corporate borrowings.

» Read more about: SoCal Governments Target Swap-Tainted Banks »

Readers of Monday’s New York Times may be forgiven for thinking an article by James Dao was about a new insult to America’s military veterans. After all, Dao reported that soon all vets separated from active duty within the past year, without dishonorable discharges, might be facing an even harsher existence than military life – as Walmart employees. Study after study has shown the retail behemoth to be a cutthroat employer of last resort, most of whose business innovations seem to involve new ways to save the corporation money by slashing employee hours and benefits.

Somehow, though, that didn’t figure much into the Times story. Instead, we read about a patriotic company with plans to hire 100,000 service men and women – essentially any American vet who needs a job. The recruitment begins Memorial Day, no less. According to the Times:

“Gary Profit,

» Read more about: Vets to Enter Walmart’s Supply Chain of Command »

Source: Warehouse Workers United

» Read more about: Walmart Cambodian Supplier Shuts Plant, Stiffs Workers »

TARP – the infamous Troubled Assets Relief Program that bailed out Wall Street in 2008 – is over. The Treasury Department announced it will be completing the sale of the remaining shares it owns of the banks and of General Motors.

TARP – the infamous Troubled Assets Relief Program that bailed out Wall Street in 2008 – is over. The Treasury Department announced it will be completing the sale of the remaining shares it owns of the banks and of General Motors.

But in reality it’s not over. The biggest Wall Street banks are now far bigger than they were four years ago when they were considered too big to fail. The five largest have almost 44 percent of all US bank deposits.

That’s up from 37 percent in 2007, just before the crash. A decade ago they had just 28 percent.

The biggest banks keep getting bigger because they can borrow more cheaply than smaller banks. That’s because investors believe the government will bail them out if they get into trouble, rather than force them into a form of bankruptcy (as the new Dodd-Frank law makes possible).

» Read more about: It’s Time to Roll Up the Welcome TARP for Big Banks »

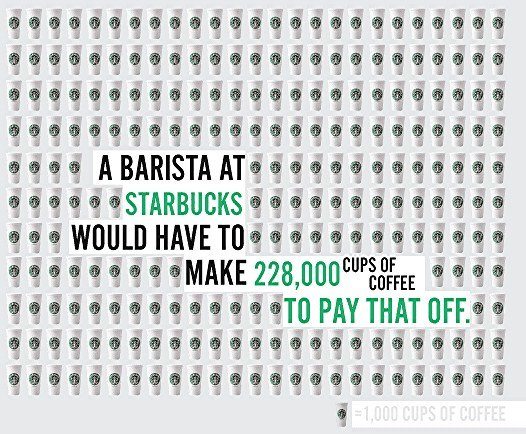

The following infographic first appeared with frugaldad.com‘s “College Isn’t Cheap” post and is republished with permission.

In 1996 I began working at the Parent Center of Wilmington Middle School. I quickly learned how students suffer from asthma, respiratory deficiencies, malnourishment, cancer and autism. Many of these poor health conditions are linked to the pollution and poverty of the area.

I decided to join the Coalition for Clean & Safe Ports, hoping to help clean our air and reduce disease in my community. Over the past several years we have made huge progress. I believe these accomplishments were possible because so many of us came together, from residents and community-based organizations to port truck drivers, lawmakers and unions. Although it is a cliché to say there is strength in unity, in this case it was true.

Today we are fighting to change the conditions of port truck drivers – and we are still unified.

We believe that everyone who works should be valued by their employer.

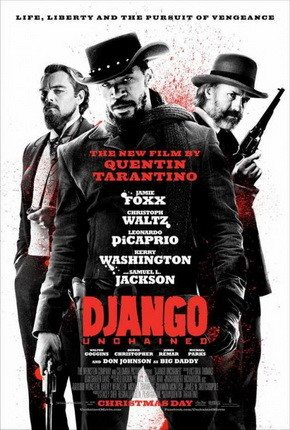

2013 is making it difficult to avoid one of America’s greatest sins—slavery. We’ve just marked the 150th anniversary of the Emancipation Proclamation, and a plethora of films, documentaries and TV specials are scheduled to address slavery.

2013 is making it difficult to avoid one of America’s greatest sins—slavery. We’ve just marked the 150th anniversary of the Emancipation Proclamation, and a plethora of films, documentaries and TV specials are scheduled to address slavery.

One blockbuster hit that’s playing in cinemas now, and is likely to walk away with several Golden Globes and Oscars, is Quentin Tarantino’s Django Unchained.

Django Unchained depicts a slave-turned-bounty hunter (Jamie Foxx) who fearlessly treks across the U.S. to find his wife (Kerry Washington) in order to rescue her from a brutal Mississippi plantation owner (Leonardo DiCaprio).

The film is classic Tarantino; this time a homage to the spaghetti western with romance and revenge narrative. Tarantino set the story in the most unlikely of places— America’s Deep South before the Civil War in 1858.

Tarantino is known as the “King of Carnage,” and his films’ aestheticized depictions of violence (which he calls “movie violence”) is both cruelly disturbing yet undeniably entertaining.

» Read more about: The Peculiar Controversy: Quentin Tarantino’s “Django” »

Expect scuffles between Jerry Brown and legislative Democrats over the governor’s budget blueprint.

Expect scuffles between Jerry Brown and legislative Democrats over the governor’s budget blueprint.

California’s social services have certainly been cut to the bone during the recession. But Brown’s proposal for a balanced budget is a remarkable and critically important achievement which sends a message to the rest of the country:

That the bluest of all the big states can get its fiscal house in order. This was enabled, of course, by the modest tax increases in Prop. 30, passed by voters in November. Watch here as a buoyant and frisky Jerry Brown explains – in his own inimitable way – what this means.

California’s balanced budget is a repudiation of claims by conservatives that only Republican-led states can manage their books and grow their economies. Thirty states have Republican governors and all but six of them have legislative majorities, making possible all sorts of right-wing mayhem on worker,

The New York Times and other sources report today that Aaron Swartz, a co-founder of the social news site Reddit, was found hanged in his Brooklyn apartment. “At 14,” the Times noted, “Mr. Swartz helped create RSS, the nearly ubiquitous tool that allows users to subscribe to online information.”

The 26-year-old computer prodigy was under federal indictment for hacking into JSTOR, an online academic resource whose materials are available on a subscription-only basis, and making nearly its entire library of literary and scientific articles available to the public.

At the time of his death Swartz was awaiting trial and faced up to 35 years in prison. (In 2009, Swartz hacked into the U.S. government’s PACER system, which tracks federal court cases, and made available online millions of its documents. He was not charged in that incident.)

In a September 15, 2011 Frying Pan News post,

» Read more about: Internet Activist Aaron Swartz, 26, Apparent Suicide »

As President Obama prepares to nominate his current Chief of Staff, Jack Lew, to the Treasury Secretary position, attention to Lew’s record and loopy signature is at an all-time high. Now, vigilant labor journalist Josh Eidelson has unearthed information on Lew’s pivotal role in busting the NYU grad student union.

The NYU graduate student union, which enjoyed official status from 2000 to 2005, was the only graduate student union to ever exist as a private university. Functioning as a case study for the political swings of the NLRB as well as a number of graduate student and adjunct professor organizing drives, the NYU Graduate Student Union (GSOC) has persevered as an informal organizing group regardless of official recognition.

The GSOC enjoyed support from within NYU and outside of it, and they didn’t lose their official bargaining status without a fight. Eidelson reports for Salon:

While graduate student teachers and researchers are unionized at many public universities,

Every year millions of Americans are victims of what some call wage theft — a practice in which a company fails to compensate workers for their time, short-changes them on their benefits or intentionally misclassifies employees in order to save money. And even though all that is illegal, Kim Bobo, executive director of Interfaith Worker Justice and author of Wage Theft in America, says it’s surprisingly common in the U.S.

Every year millions of Americans are victims of what some call wage theft — a practice in which a company fails to compensate workers for their time, short-changes them on their benefits or intentionally misclassifies employees in order to save money. And even though all that is illegal, Kim Bobo, executive director of Interfaith Worker Justice and author of Wage Theft in America, says it’s surprisingly common in the U.S.

“Minimum wage and overtime violations are two of the most common ways that wage theft occurs. Another way is payroll fraud, when employers intentionally call people independent contractors when they are really employees. Now if your boss — not you — declares you an independent contractor, you probably aren’t one. Then there is also tip stealing. About 10 percent of tipped workers actually don’t get their tips; their employers just don’t give it to them,”

A federal judge Thursday ordered Walmart to be included in a lawsuit filed by warehouse workers embroiled in a labor dispute with employers contracted by the retail giant. In downtown Los Angeles, United States District Court Judge Christina A. Snyder denied Walmart’s request to be excluded from the case (Carrillo v. Schneider Logistics, Inc.), which began litigation in October, 2011. At that time, several warehouse employees in Mira Loma filed suit against Schneider Logistics, Inc., Premier Warehousing Ventures, Rogers-Premier Unloading Services and Impact Logistics, Inc. for alleged violations of federal and state labor laws.

Walmart had argued that the plaintiffs had waited too long before seeking to include Walmart as a defendant. This delay, Walmart claimed, placed the company in the unfair position of having little time to catch up with discovery evidence and to prepare for an anticipated plaintiff class-action motion later this month. The Bentonville, Arkansas corporation also argued against inclusion in the suit because Walmart is not the warehouse workers’ employer.

» Read more about: Warehouse Workers Win New Round in Walmart Case »

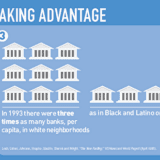

Infographic Source: ACLU and aclu.org’s “Big Profits, Broken Dreams”

» Read more about: How Banks Subprimed Black and Latino Morgtages »

How much do the newly enacted tax hikes on the wealthiest Americans actually affect them? Hardly at all.

Almost all of the debate that convulsed Capitol Hill in December concerned the reinstatement of the highest marginal tax rate on earned income — that is, on wages and salaries. But as Fitzgerald said, the rich are different from you and me, and one of the primary ways they’re different is that they don’t get their income from wages and salaries.

In 2006, the bottom four-fifths of U.S. tax filers got 82 percent of their income from wages and salaries, a Congressional Research Office study found. The richest 1 percent, however, got just 26 percent of their income that way; for the richest one-tenth of 1 percent, the figure is just 18.6 percent.

The study also looked at dividends and capital gains. The bottom four-fifths got just 0.7 percent of their income from those sources.

The news today [January 4] from the Bureau of Labor Statistics is that the U.S. job market is treading water.

The number of new jobs created in December (155,000), and percent unemployment (7.8), were the same as the revised numbers for November.

Also, about the same number of people are looking for work (12.2 million), with additional millions too discouraged even to look.

Put simply, we’re a very long way from the job growth we need to get out of the gravitational pull of the Great Recession. That would be at least 300,000 new jobs per month.

All of which means job growth and wage growth should be the central focus of economic policy, not deficit reduction.

Yet all we’re hearing from Washington — and all we’re likely to hear as Republicans and Democrats negotiate over raising the debt ceiling — is how to cut the deficit.

» Read more about: Jobs Must Be Our Goal, Not Deficit Reduction »