Speaker Boehner’s debacle in failing to get his own caucus to support his “Plan B” is not only his failure, it shows the complete disarray of the congressional Republican Party. They are simply incapable of a coherent response to a problem that calls upon them to go beyond campaign talking points.

Speaker Boehner’s debacle in failing to get his own caucus to support his “Plan B” is not only his failure, it shows the complete disarray of the congressional Republican Party. They are simply incapable of a coherent response to a problem that calls upon them to go beyond campaign talking points.

This gives the President and Democrats in the House and Senate an opportunity to set fiscal cliff policy, in two stages. First, before the end of 2012, they should pass a bill in the Senate that would end the Bush tax cuts for those earning over $250,000 per year, as the President promised during the campaign. The bill should also extend unemployment coverage for the long-term unemployed, extend the debt limit for at least a year, and adjust the Alternative Minimum Tax to inflation. It should suspend (not cancel) the mandatory across-the-board spending cuts in the Fiscal Cliff law.

One of the proposals floated for months in the fiscal bluff debate in Washington, D.C., is a change to the formula used to measure inflation for Social Security Cost-of-Living Adjustments (COLAs) called the “chained” CPI. Let’s be clear: This is a benefit cut. These COLAs make sure seniors’ income keeps pace with the rising costs of housing and food. The “chained” CPI would cut future Social Security benefits by as much as $2,432 for someone who is 17 years old today. Studies from the Center for Economic and Policy Research (CEPR) show that not only is the “chained” CPI a benefit cut, it eventually will lead to higher taxes for most working people.

One of the proposals floated for months in the fiscal bluff debate in Washington, D.C., is a change to the formula used to measure inflation for Social Security Cost-of-Living Adjustments (COLAs) called the “chained” CPI. Let’s be clear: This is a benefit cut. These COLAs make sure seniors’ income keeps pace with the rising costs of housing and food. The “chained” CPI would cut future Social Security benefits by as much as $2,432 for someone who is 17 years old today. Studies from the Center for Economic and Policy Research (CEPR) show that not only is the “chained” CPI a benefit cut, it eventually will lead to higher taxes for most working people.

For instance, CEPR estimated that the change to the “chained” CPI would lead to a cut in benefits of three percent after 10 years, six percent after 20 years and nine percent after 30 years.

» Read more about: Chained CPI: Proposed New COLA Leaves Bad Taste »

My name is Cathy Youngblood. I work as a housekeeper at the Hyatt Andaz in West Hollywood. There are many positive things about being a housekeeper. I get to meet the world. I have a real bond with the other women I work with. I also take pride in working in a field where I give comfort and pleasure to people when they travel.

My name is Cathy Youngblood. I work as a housekeeper at the Hyatt Andaz in West Hollywood. There are many positive things about being a housekeeper. I get to meet the world. I have a real bond with the other women I work with. I also take pride in working in a field where I give comfort and pleasure to people when they travel.

There are also challenges to being a housekeeper. Every day the work is exhausting and physically debilitating. And management doesn’t always really listen when we have ideas about how to make the work safer or more efficient.

I care about my job, but also I see how things could be better. That’s why Hyatt needs someone like me on its board of directors. The current corporate officers might have business sense, but I have common sense. They push paper, I do the physical labor.

» Read more about: Hotel Worker Says: Put Me on Hyatt's Board! »

“And it came to pass in those days, that there went out a decree from Caesar Augustus, that all the world should be taxed.”

“And it came to pass in those days, that there went out a decree from Caesar Augustus, that all the world should be taxed.”

Those are the opening lines from the Christmas story according to St. Luke, as written down by the team of scholars working under the direction of King James of England 500 years ago. Different translators have used different phrases over the centuries, but the frame for telling this story has always been taxes.

The Roman Empire wanted to make sure everyone paid their taxes, so Rome required its subjects to return to their towns of birth to sign into the national registry as part of a census, which allowed the keepers of the treasury to know who had paid and who had not. And that’s how Jesus got to be born in Bethlehem.

In California, we face a different dilemma. For decades now,

(This article first appeared on Equal Voice News.)

Rosa Rivera worked in housekeeping at the Best Western Golden Sails Hotel in Long Beach, Calif., for 20 years. In all those years, she never received health benefits, a paid vacation or a paid sick day. She often cleaned 17 to 18 rooms a day.

When Rivera heard that Long Beach voters on Nov. 6 had resoundingly approved Measure N, requiring nonunion hotels with more than 100 rooms to pay its workers at least $13 an hour and provide five paid sick days a year, she was overjoyed.

With the new wage increase, Rivera’s weekly paycheck would jump from $320 a week to $520, before taxes. She dared to dream of what it would be like to have almost $2,000 a month to live on.

Rivera, 43, shares a one-bedroom apartment with her daughters and granddaughters.

» Read more about: Hotel Grinch Lays Off Workers as Living Wage Law Takes Effect »

Maybe it’s time for the millions of American victims of gun violence to come out of the shadows and make real what guns are doing to our lives.

Maybe it’s time for the millions of American victims of gun violence to come out of the shadows and make real what guns are doing to our lives.

I’m one of those Americans. My white-haired, 82-year-old mother, after two hospitalizations for major depression, was able to easily purchase handguns from local Westside gun shops. The first time she let me know and, together with a female police officer, we took it away from her. The second time she used a gun to end her life.

I’ve often tried to picture the gun dealers who helped her make these purchases – standing behind the glass counter, advising this elderly woman on which gun would theoretically assure her personal safety. Never having used a gun in her life before, she went into the Santa Monica mountains to practice shooting it.

As we headed to my mom’s senior housing facility to retrieve the first gun,

(This post first appeared on Union Plus.)

No holiday tradition competes with the family meal. Between desserts decorated full of cheer and marvelous meats that melt in your mouth, ‘tis the season for a full stomach. Luckily for union members, members of the United Food and Commercial Workers (UFCW), the Bakery, Confectionery, Tobacco Workers and Grain Millers (BCTGM) and the United Farm Workers (UFW) have an amazing variety of ingredients such as Hershey’s chocolate and Montpelier Almonds to create the most delicious and view-licious recipes. Here are five fun holiday dessert recipes to help you be union, buy union and bake union.

Rolo Pretzel Delights (Thank the UFCW members for Rolo)

Ingredients: Small pretzels, ROLO Chewy Caramels in Milk Chocolate, Pecan halves

Directions:

(Note: This feature first appeared September 21, 2012.)

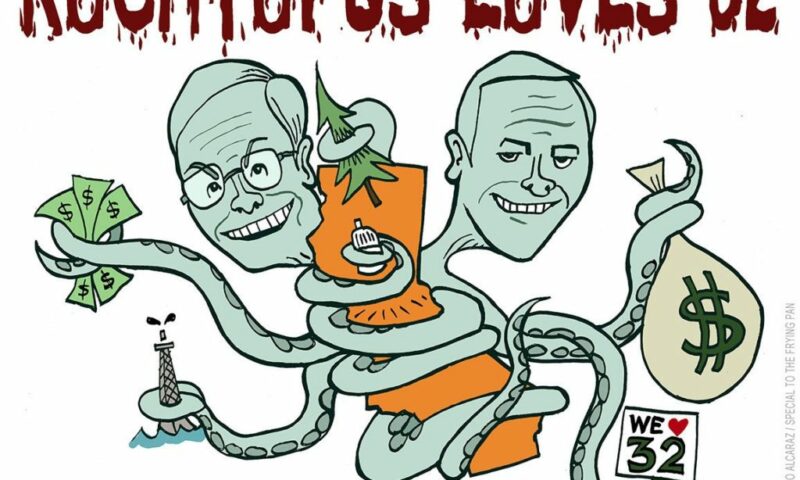

On September 14 the Web exploded with news that billionaire industrialists Charles and David Koch had donated $4 million in support of Proposition 32. A San Francisco Chronicle editorial noting the donation labeled the brothers “conservative ideologues” – a moniker often applied to the Kochs. This description, however, gives the Kochs far too much credit for their supposed philosophical purity—particularly as it relates to the Prop. 32 battle.

Despite their reputations as libertarian true believers, the Koch brothers are nothing if not practical businessmen, who have no trouble taking advantage of government subsidies when it bolsters their bottom line. (Koch Industries, for instance, was for years heavily invested in the $6 billion, federally subsidized ethanol industry.) That bottom line runs up and down the state of California, where Koch Industries has hundreds of millions of dollars invested through its subsidiary Georgia-Pacific—a gypsum,

» Read more about: Classic Koch: How Prop. 32 Could Enrich Two Billionaires »

President Obama must remember the message of election night and back away from cutting Social Security benefits.

That didn’t last nearly as long as I had hoped. I put on my Obama baseball cap – the one I picked up from a street vendor walking to the inauguration four years ago – a few weeks before the November election. I’ve worn it every day since, to both celebrate his victory and cheer on the president for keeping to a progressive promise in the fiscal negotiations. Part of that promise was telling the Des Moines Register that Social Security benefits should not be cut. But it looks like my cap is going back on the shelf if reports that Obama is willing to cut Social Security benefits prove to be true.

There are three things to keep in mind about the president agreeing to cuts in Social Security benefits.